Beginning a business requires cash, backing, and direction. Many hopeful business visionaries battle because of an absence of assets. To address this issue, the Mukhyamantri Udyami Yojana gives monetary help to assist new organizations with developing. This government initiative supports young entrepreneurs by offering loans, subsidies, and training.

The Mukhyamantri Udyami Yojana Bihar is designed to create employment opportunities. It helps individuals start businesses by reducing financial burdens. This guide explains everything about this scheme, including eligibility, benefits, and application steps.

What is Mukhyamantri Udyami Yojana?

The Mukhyamantri Udyami Yojana is a financial aide program by the Madhya Pradesh government. It offers financial assistance to energetic money managers. The point is to propel free work and monetary turn of events.

Under this arrangement, propels going from ₹10 lakh to ₹2 crore are open. The public authority additionally gives sponsorships and credit ensures. The plan guarantees that qualified applicants get the essential monetary help without insurance.

Key Elements of Mukhyamantri Udyami Yojana 2025

The Mukhyamantri Udyami Yojana Bihar offers different advantages to business people. This plan gives monetary security and business valuable learning experiences.

- Loan assistance from ₹10 lakh to ₹2 crore

- Subsidy of 15 percent on capital investment

- Special benefits for BPL applicants

- Interest subsidy to reduce financial burden

- Loan guarantee for easier approval

- Business training and mentorship

The government ensures that all eligible candidates receive financial support. This aides in decreasing joblessness and advancing new organizations.

Qualification Standards for Mukhyamantri Udyami Yojana

Not every person can apply for this plan. The Mukhyamantri Udyami Yojana has explicit qualification models.

| Eligibility Criteria | Details |

| Age | 18 to 40 years |

| Education | Minimum 10th pass |

| Residency | Must be a resident of Madhya Pradesh |

| Business Type | Manufacturing, service, or trading |

| Loan Default | Should not have a history of loan defaults |

If you meet these conditions, you can apply for the scheme. The application process is simple and online.

Benefits of Mukhyamantri Udyami Yojana

The Mukhyamantri Udyami Yojana Bihar provides various benefits to entrepreneurs. These include financial assistance, subsidies, and training.

1. Loan Assistance

Entrepreneurs receive loans from ₹10 lakh to ₹2 crore. This helps them start or expand their businesses.

2. Interest Subsidy

The government offers an interest subsidy. This reduces the financial burden on borrowers.

3. Subsidies and Grants

- Regular applicants get a 15 percent subsidy on machinery costs (up to ₹12 lakh).

- BPL applicants receive a 20 percent subsidy (up to ₹18 lakh).

4. Loan Guarantee

The government provides a loan guarantee. This makes it easier to get approval from banks.

5. Business Training

Applicants receive training in business management, financial planning, and marketing.

Required Documents for Mukhyamantri Udyami Yojana

Candidates need to present a few reports. These reports assist with confirming qualification and cycle the advance.

| Document Name | Purpose |

| Aadhar Card | Identity proof |

| Voter ID | Address proof |

| 10th Marksheet | Educational proof |

| Income Certificate | Proof of economic status |

| Caste Certificate | If applicable |

| Bank Passbook | Bank details |

| Project Report | Approved by a Chartered Accountant |

| Passport Size Photo | Recent photograph |

Applicants should keep these documents ready before applying. Any missing document can lead to rejection.

How to Apply for Mukhyamantri Udyami Scheme?

Applying for the Mukhyamantri Udyami Yojana Bihar is a simple process. The application is done online.

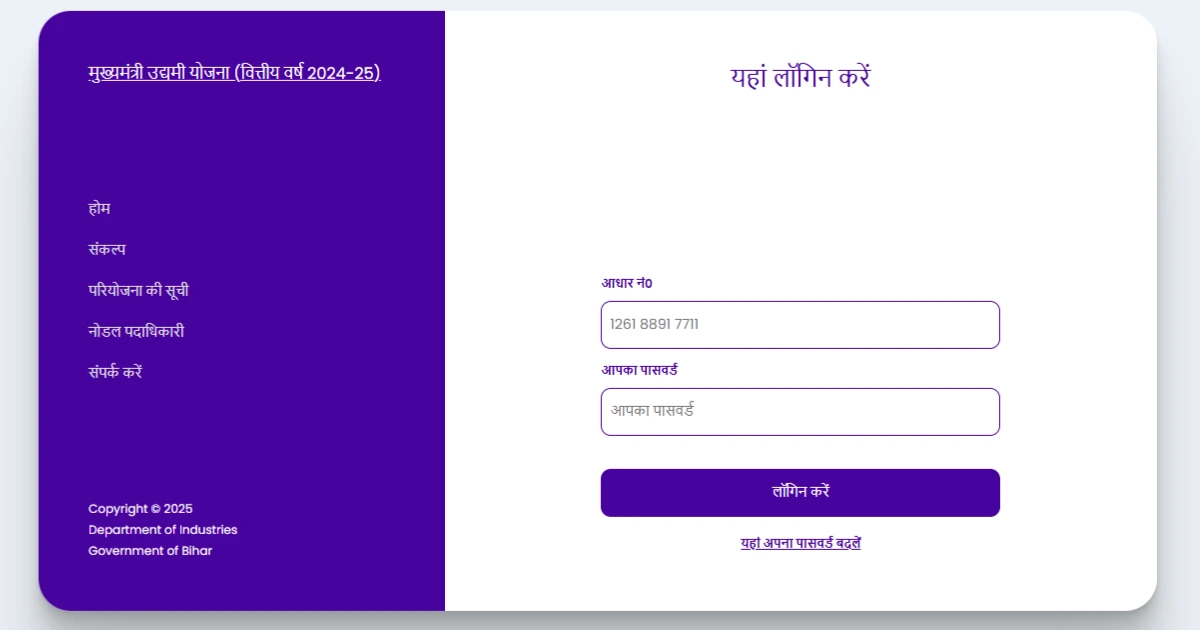

- Visit the official government website.

- Register using Aadhar details.

- Fill out the application form with personal and business details.

- Upload all required documents.

- Submit the application form.

- The loan request is sent to banks for approval.

- Once approved, the loan amount is transferred to the applicant’s account.

Applicants should ensure all details are correct. Any mistake can delay the approval process.

Loan Amount and Subsidy Details

The Mukhyamantri Udyami Yojana gives monetary help in view of business needs. The table beneath makes sense of the advance and appropriation subtleties.

| Category | Loan Amount | Subsidy (%) | Maximum Subsidy (₹) |

| General Applicants | ₹10 lakh – ₹2 crore | 15% | ₹12 lakh |

| BPL Applicants | ₹10 lakh – ₹2 crore | 20% | ₹18 lakh |

This financial aid helps businesses grow and become successful.

Why Should You Apply for Mukhyamantri Udyami Yojana?

The Mukhyamantri Udyami Yojana Bihar offers several advantages. This scheme is a great opportunity for young entrepreneurs.

- Financial support to start a business

- Reduced loan burden due to subsidies

- Government-backed security for loan approval

- Training for better business management

- Increased employment opportunities

This scheme ensures that young entrepreneurs can build successful businesses.

Business Sectors Covered Under This Scheme

Its covers multiple business sectors. The scheme allows applicants to start businesses in different fields.

| Business Type | Examples |

| Manufacturing | Small-scale industries, food processing |

| Service | IT services, logistics, repair shops |

| Trading | Wholesale, retail, supply chains |

Entrepreneurs can choose the sector that suits them best.

Conclusion

The Mukhyamantri Udyami Yojana is an extraordinary drive for youthful business people. This plan gives monetary help, business preparing, and sponsorships to assist new organizations with developing. The public authority upheld credit ensure guarantees more straightforward advance endorsements.

This Yojana Bihar assumes a vital part in advancing independent work. In the event that you are wanting to begin a business, this plan can offer the important monetary help. Apply now and venture out towards building a fruitful business.

FAQs

Q1. What is the Mukhyamantri Udyami Yojana?

Ans. It is an administration conspire that gives monetary help and preparing to youthful business people in Madhya Pradesh.

Q2. Who can apply for this plan?

Ans. People somewhere in the range of 18 and 40 years, who have passed the tenth grade, and are occupants of Madhya Pradesh can apply.

Q3. What is the credit sum under this plan?

Ans. Qualified business people can get advances going from ₹10 lakh to ₹2 crore.

Q4. Is insurance expected for the advance?

Ans. No, the public authority gives a credit ensure, making it more straightforward to get endorsement.

Q5. How might I apply for this plan?

Ans. Applications are submitted internet based through the authority government site.

Read More Blogs:-)